38 zero coupon bond yield calculation

How To Calculate Yield To Maturity Of Zero Coupon Bond In Excel Select the cell you will place the calculated result at type the formula PV B4B30B2 into it and press the Enter key. This makes calculating the yield to maturity of a zero coupon bond straight-forward. F represents the Face or Par Value. Insert the following function into B18. The formula for determining approximate YTM would look like below. Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Bond Equivalent Yield Formula - FundsNet The bond equivalent yield (BEY) formula provides a method for calculating the annual yield of fixed-income securities, including discount or zero-coupon bonds with returns on a less than annual basis. BEY is an incredibly useful tool for investors to compare the potential performance of traditional bonds with an annual return against those with more frequent... View Article

Zero coupon bond yield calculation

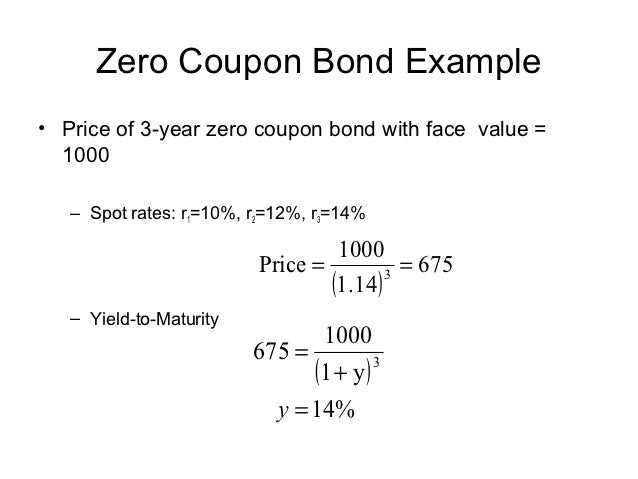

› terms › bBond Equivalent Yield (BEY) Definition - Investopedia Mar 24, 2020 · Bond Equivalent Yield - BEY: The bond equivalent yield (BEY) allows fixed-income securities whose payments are not annual to be compared with securities with annual yields. The BEY is a ... Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [ {F/PV}]^ (1/t) =1+r Where F -face value of the bond PV- current value of the bond t -time to maturity r- Interest rate For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of $400. Zero Coupon Bond Yield: Formula, Considerations, and Calculation The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero coupon bond yield calculation. Coupon Equivalent Rate (CER) Definition - Investopedia Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 * 3.96. Compared with a bond paying an 8% annual coupon we'd choose the zero-coupon bond... Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%. Bond Pricing - Formula, How to Calculate a Bond's Price A zero-coupon bond pays no coupons but will guarantee the principal at maturity. Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to ...

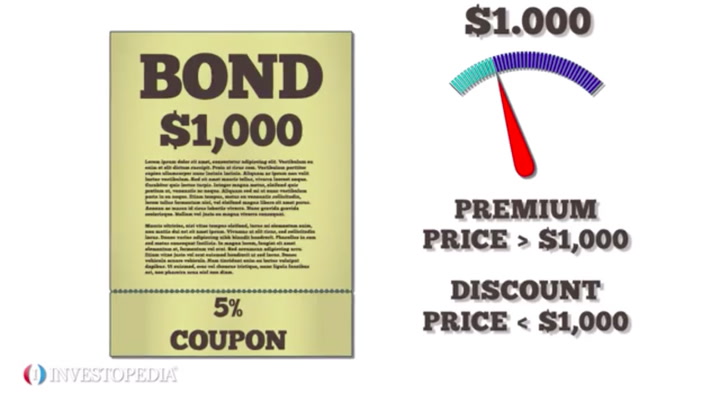

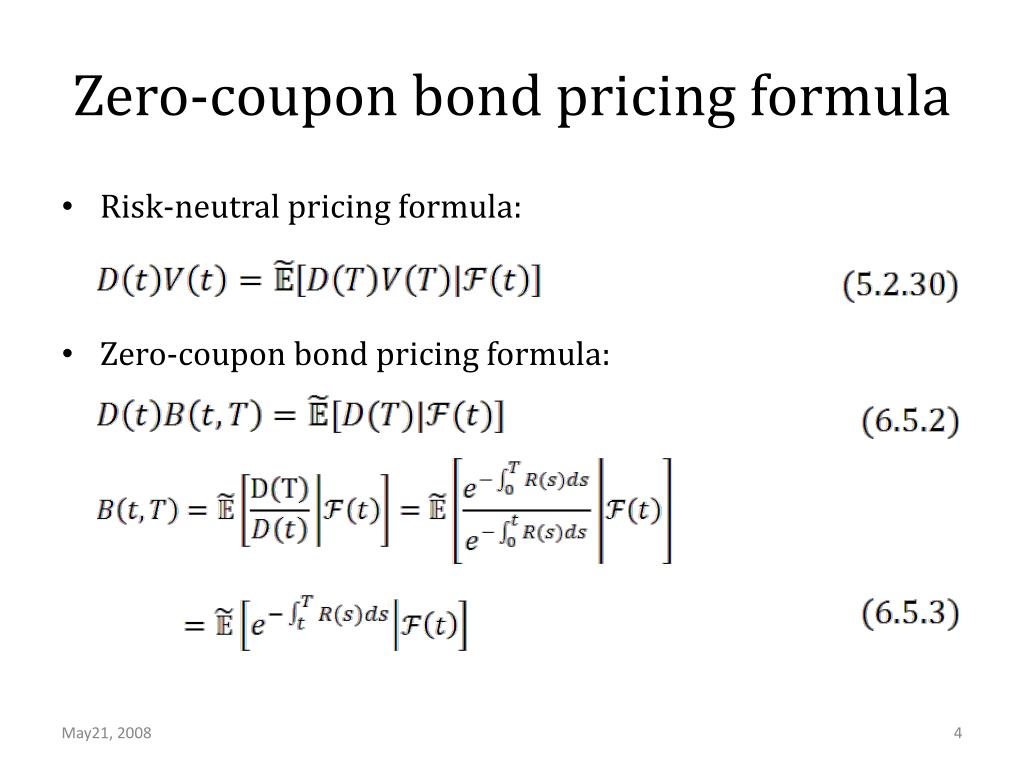

ZeroCouponBond: Zero-Coupon bond pricing in RQuantLib: R Interface to ... The ZeroCouponBond function evaluates a zero-coupon plainly using discount curve. More specificly, the calculation is done by DiscountingBondEngine from QuantLib. The NPV, clean price, dirty price, accrued interest, yield and cash flows of the bond is returned. For more detail, see the source code in the QuantLib file test-suite/bond.cpp . Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... › financial › bond-yieldBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: › knowledge › current-yieldCurrent Yield: Bond Formula and Calculator [Excel Template] Current Yield = Annual Coupon ÷ Bond Price; For instance, if a corporate bond. Current Yield = $80 Annual Coupon ÷ $970 Bond Price; Current Yield = 8.25%; Current Yield of Discount, Par & Premium Bonds. The difference between the current yield and coupon rate of a bond stems from the pricing of the bond diverging from its par value.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example For instance, if a zero-coupon bond was sold at a $100 discount and matures in four years, its holder would have to pay the applicable bond interest tax rate on $25 worth of the bond's total $100 ... What Is a Zero Coupon Yield Curve? (with picture) The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ... How Do I Calculate the Yield of an Inflation Adjusted Bond? The real yield calculation would use the secondary market price (like any other bond) of $925, but use the inflation-adjusted coupon payment of $42. The real yield would thus be: 4.54% (42 ÷ 925).... › terms › bBond Definition - Investopedia Feb 23, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Price of a Zero coupon bond - Calculator - Finance pointers August 20, 2021. August 20, 2021. | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face ...

Zero Coupon Bond Calculator Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Estimate yield of coupon bond given yield of zero coupon bond Let's say the fair coupon on the 2010 coupon paying bond is C. Then this bond is worth 100. Its cash flows in 2007,2008,2009,2010 are respectively C,C,C, (100+C) and we can use the discount factors in the OP to calculate the present value as follows: $$ PV = 0.9553C +0.9107 C+ 0.8620C+ 0.8108(100+C)$$.Equating this to 100 and solving, we find C to be 5.34, less than the yield of the 2010 ...

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

money.usnews.com › investing › bondsHow Bond Maturity Works | Bonds | US News Mar 12, 2020 · A savings bond is an example of a zero-coupon bond because the interest payments are added to the bond's principal value, rather than paid out periodically. Holders can check savings bond maturity ...

Quant Bonds - Between Coupon Dates - BetterSolutions.com There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function 2) Using the YIELD function 3) Using the XIRR function ... Instead of thinking of 1 bond with several cash flows, change this to a stream to zero-coupon bonds 2) Value each zero-coupon bond at a different rate based ...

Zero Coupon Bond | Definition, Formula & Examples - Study.com In order to calculate the ytm of zero-coupon bond, assuming a yearly discount rate, the following zero-coupon bond formula is used: ... The yield to maturity on 1-year zero-coupon bonds is ...

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Bond Price Calculator | Formula | Chart As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

How do you construct a zero coupon curve from the current market yield ... The yields at a tenor of 0.5 years calculated above is a zero-coupon rate and your starting point for bootstrapping the zero-coupon curve. We then use bootstrapping to construct the zero/spot curve. We use the interpolated yield for each tenor as the ANNUAL COUPON which defines the cash flows before maturity.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://www.finpricing.com/images/zero-coupon-bond-valuation-FinPricing.jpg)

Post a Comment for "38 zero coupon bond yield calculation"