40 advantage of zero coupon bonds

What is a Coupon Value? Definition and Calculation A zero-coupon rate bond does not pay an annual coupon rate It has longer maturity dates and greater volatility but sells for a discount An entity sells a 20-year zero-coupon rate bond at $5,000 The investor earns no interest during the 20 years but receives $30,000 at the maturity date Zero Coupon 2025 Fund | American Century Investments Invests in zero-coupon bonds, providing a dependable rate of return if held to maturity. Performance Data reflects past performance for Investor Class shares, assumes reinvestment of dividends and capital gains and is no guarantee of future results.

Uganda Government Bonds - Yields Curve The Uganda 10Y Government Bond has a 15.295% yield. 10 Years vs 2 Years bond spread is 279.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 8.50% (last modification in July 2022). The Uganda credit rating is B, according to Standard & Poor's agency.

Advantage of zero coupon bonds

What Is A Bond? - Forbes Advisor INDIA These bonds hedge against inflation and are offered by the Government. Indexed against inflation, their interest rates fall and rise as per inflation. Zero Coupon Bonds These bonds don't pay any... Zero-Dividend Preferred Stock Definition - Investopedia Advantages: The lack of taxes that would normally be warranted on dividends. Also, the lump sum payout would be taxed as a capital gain as opposed to net income, which would be at a lower rate. 2... Are Bonds a Good Investment When Interest Rates Are High? Hence, if bond prices change, so do bond rates, and thus, yields. For example, suppose you have a $500 bond with an annual coupon payment of $50. This gives the bond a 10% yield ($50/$500). But if ...

Advantage of zero coupon bonds. Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... They are zero-coupon bonds, meaning an investor buys them at a discount to par value. Instead of paying a coupon interest rate, T-bills are eventually redeemed at par value to create a positive yield to maturity. ... This is another advantage of short-term TIPS: their lower volatility can decrease sequence risk and increase the odds of a ... Key Features of Government Securities - NSE India Government bonds and State Development Loans pay interest every six months; Treasury bills are zero coupon bonds. They are issued by discount and redeemed at face value; Advantages of investing in G-sec, SDL and T-bill. Safety: Being Sovereign security, no default risk; Ease of Exit: Investor can sell the government bonds in the secondary market How to Invest in Bonds: A Beginner's Guide to Buying Bonds There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ... Accrual Bond Definition - Investopedia Similar to a zero-coupon bond, an accrual bond, or Z tranche, has limited to no reinvestment risk. This is because the interest payment made to bondholders is delayed. However, accrual bonds, by...

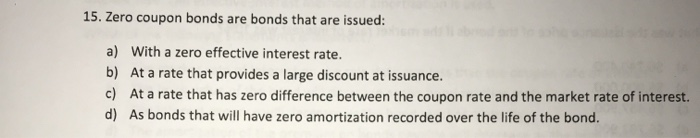

Basics Of Bonds - Maturity, Coupons And Yield Bonds that don't make regular interest payments are called zero-coupon bonds - zeros, for short. As the name suggests, these are bonds that pay no coupon or interest. Instead of getting an interest payment, you buy the bond at a discount from the face value of the bond, and you are paid the face amount when the bond matures. Looking to put cash to work? Consider short-term Treasury bills Treasury bills (often called T-bills) are a bit different than your standard bank account or CD. They are zero-coupon bonds, meaning an investor buys them at a discount to par value. Instead of paying a coupon interest rate, T-bills are eventually redeemed at par value to create a positive yield to maturity. 7 REIT Bear Beliefs: True, False Or Nuanced | Seeking Alpha REITs have a higher dividend yield than the S&P, so the duration of REITs is lower in the same way that the duration of a 30 year coupon bond is shorter than a 30 year zero coupon bond. What Should You Do About Bond Price Declines? - forbes.com With the interest rate of 2%, you pay about $825 for your bond. You expect to buy another 10-year bond paying the same interest rate when the first one matures. Now suppose that the interest rate ...

What Are Bonds and How Do They Work? - The Balance Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. 11 Convertible bonds: Can be converted into a different security—typically shares of the same company's common stock. How to Compare the Yields of Different Bonds - Investopedia In order to properly compare the yields on different fixed-income investments, it's essential to use the same yield calculation. The first and easiest conversion changes a 360-day yield to a 365 ... Accounts That Earn Compounding Interest - The Motley Fool Zero-coupon bonds: These bonds generate the equivalent of compound interest to compensate for the risk associated with holding zero coupon bonds. A zero coupon bond holder purchases a bond at a... Why Buy Bonds If Interest Rates Will Rise? | AAII Updated July 1, 2022. The reason investors buy bonds is to achieve a secure cash flow and to reduce their risks in the stock market. However, bond prices and interest rates are extremely reliant on one another and the relationship between the two needs to be evaluated before pursuing. If interest rates are at a low level, some investors are ...

Lehman Investment Opportunity Note (LION) Definition LIONs were zero-coupon bonds, which means that they made no interest payments to bondholders. Instead, investors made money because the par value they received back at maturity of the bond was more...

Investing in Treasury Bills: The Safest Investment in 2022? Most bonds are usually issued with a face value of $100 or $1,000. By comparing the present value of the T-bill to its face value, an investor knows whether the bond is overvalued or undervalued. Coupon — The coupon states how much interest the bond will pay. Bonds usually pay this interest semi-annually.

Series I Savings Bonds - What They Are and How to Buy Them As zero-coupon investments, Series I certificates don't issue interest in periodic payouts; instead, the interest that each security accrues is added onto its cash-out value. When you sell a Series I bond, you receive a lump sum that includes the principal amount and all accrued interest.

The Safest Investments In 2022 For Retirees | Seeking Alpha With a 4.875% coupon, its YTM is above 5% at current prices. Much higher yields are achievable with baby bonds, and the HDO portfolio holds several with 7%+ YTMs.

ZROZ - Summary of PIMCO 25+ Year Zero Coupon U.S. Treasury Index ... The PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF aims to capture the returns of the ICE BofAML Long US Treasury Principal STRIPS Index. Price Chart 1 Month 3 Months YTD

Fair Market Value (FMV) Explained - The Motley Fool What is a Zero-Coupon Bond? While these bonds do have a place in a diversified portfolio, they're not for everyone. Competitive Advantage When doing industry analysis, understanding how a company ...

How to Invest in U.S. Saving Bonds - The Motley Fool 2. Purchasing restrictions. You can buy up to $10,000 worth of Series EE bonds in any given year. Bonds come in denominations of $25 and above in penny increments. For example, per the Treasury ...

American Century Zero Coupon 2025 Fund Investor Class Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 (k) plans. Close tooltip. American Century Zero Coupon 2025 Fund Investor Class. -4.84%. 0.82%. 1.05%. 0.67%.

Types of bonds — AccountingTools A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. This allows investors to take advantage of a run-up in the price of a company's stock. The conversion option can increase the price that investors are willing to pay for this type of bond. Bond Features

25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund - PIMCO The ICE BofAML Long U.S. Treasury Principal STRIPS Index. The ICE BofAML Long US Treasury Principal STRIPS Index is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (STRIPS) representing the final principal payment of U.S. Treasury bonds. It is not possible to invest directly in ...

Accumulation Bond Definition - Investopedia The main difference between a regular bond and a zero-coupon bond or accumulation bond is the payment of interest. A regular bond pays interest to bondholders, while a zero-coupon bond does not...

General Obligation Bonds Unlimited GO bonds without dedicated taxes are less secure than ones with dedicated taxes, but they are still safer than limited GO bonds. The bottom line on GO bonds Investors tend to seek out...

Are Bonds a Good Investment When Interest Rates Are High? Hence, if bond prices change, so do bond rates, and thus, yields. For example, suppose you have a $500 bond with an annual coupon payment of $50. This gives the bond a 10% yield ($50/$500). But if ...

Zero-Dividend Preferred Stock Definition - Investopedia Advantages: The lack of taxes that would normally be warranted on dividends. Also, the lump sum payout would be taxed as a capital gain as opposed to net income, which would be at a lower rate. 2...

What Is A Bond? - Forbes Advisor INDIA These bonds hedge against inflation and are offered by the Government. Indexed against inflation, their interest rates fall and rise as per inflation. Zero Coupon Bonds These bonds don't pay any...

Post a Comment for "40 advantage of zero coupon bonds"