39 definition of coupon rate

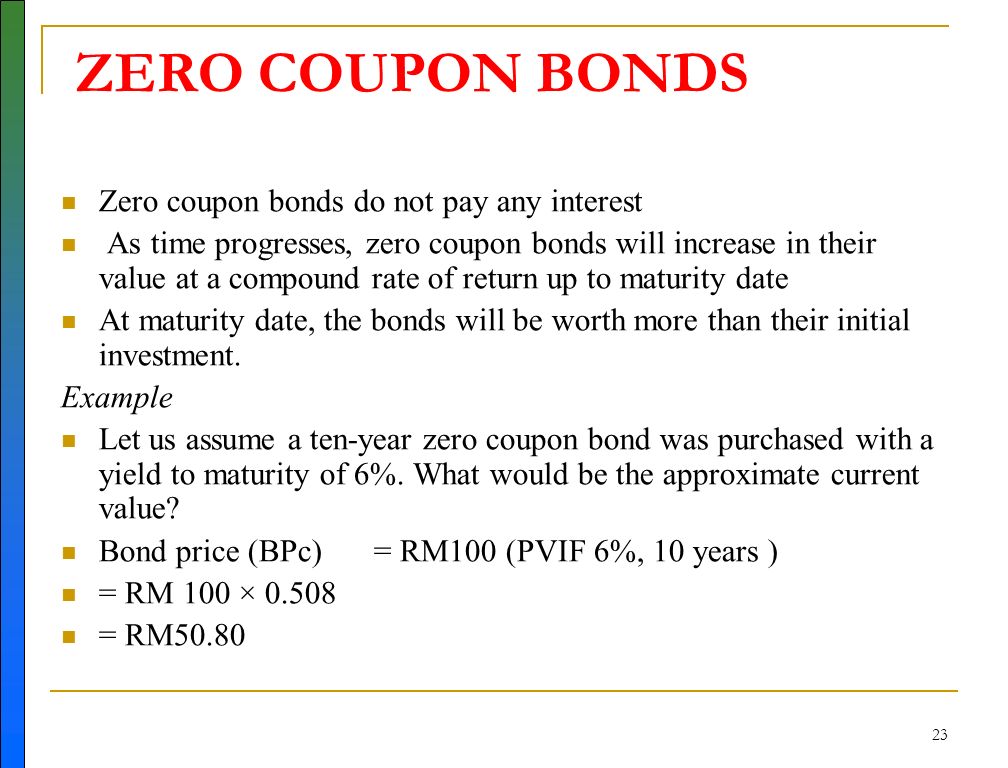

Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than … What is Coupon Rate? Definition of ... - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to ...

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.

Definition of coupon rate

Coupon rate definition and meaning | Collins English Dictionary The coupon rate is the interest rate on a bond calculated on the number of coupons per year. A tax-exempt municipal bond has a higher after-tax yield than a ... Images 16 Sept 2022 — It refers to the past practice of issuing coupons with bonds. Bond holders presented these coupons at stated intervals in order to receive ... Coupon Rate Calculator | Bond Coupon 15.07.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you …

Definition of coupon rate. What is coupon rate | Definition and Meaning - Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security ... Coupon Rate Definition - Investopedia A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value. What Is the Coupon Rate of a Bond? - The Balance Definition and Examples of a Coupon Rate — The coupon rate of a bond or other fixed income security is the interest rate paid out on the bond. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders ...

Clickthrough rate (CTR): Definition - Google Ads Help Clickthrough rate (CTR) can be used to gauge how well your keywords and ads, and free listings, are performing. CTR is the number of clicks that your ad receives divided by the number of times your ad is shown: clicks ÷ impressions = CTR. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations. Implied Rate Definition - Investopedia Jun 02, 2022 · Implied Rate: An implied rate is an interest rate that is determined by the difference between the spot rate and the forward/futures rate. The degree of relative costliness of a future rate can be ... What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond .

Nominal Interest Rate (Definition, Formula) - WallStreetMojo Bond available at 8% is a coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more as it does not consider current inflation ... Coupon Rate Calculator | Bond Coupon 15.07.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you … Images 16 Sept 2022 — It refers to the past practice of issuing coupons with bonds. Bond holders presented these coupons at stated intervals in order to receive ... Coupon rate definition and meaning | Collins English Dictionary The coupon rate is the interest rate on a bond calculated on the number of coupons per year. A tax-exempt municipal bond has a higher after-tax yield than a ...

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Post a Comment for "39 definition of coupon rate"