39 the coupon rate of a bond is equal to

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... What is the difference between a zero-coupon bond and a regular bond? Aug 31, 2020 · A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... When a Bond's Coupon Rate Is Equal ...

The coupon rate of a bond is equal to

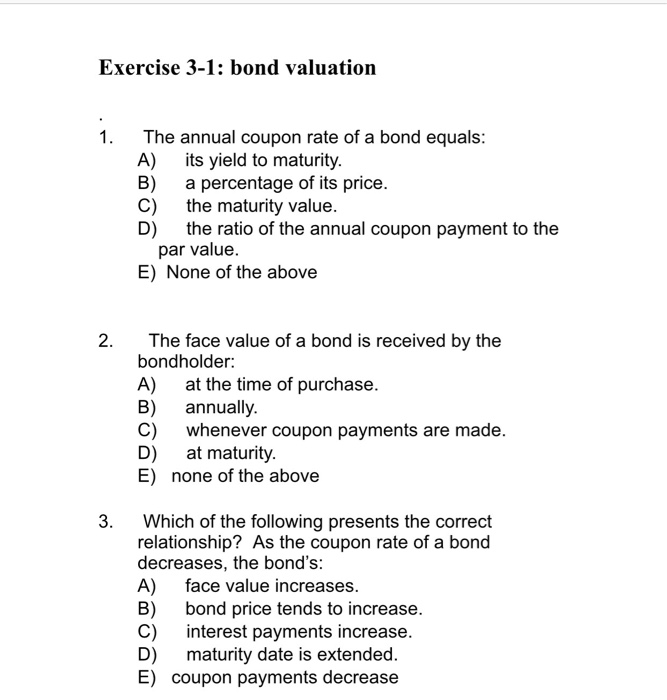

› ask › answersWhen a Bond's Coupon Rate Is Equal to Yield to Maturity Jan 13, 2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price. In other words, a bond's price is the sum of the present value of ... Bond Discount: Definition, Example, Vs. Premium Bond - Investopedia Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

The coupon rate of a bond is equal to. A discount bonds coupon rate is equal to the annual - Course Hero 13- A discount bond's coupon rate is equal to the annual interest divided by the: Multiple Choice clean price. current price. dirty price. face value. call price. Multiple Choice clean price . 14- Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.4 percent paid semiannually and 13 years to maturity. Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... Answered: What is the tex-equivalent interest… | bartleby What is the tex-equivalent interest rate needed if you purchase a municipal bond wiht a face value of %5000, a coupon rate of 4%, and a maturity date of 7 years? Assume you are in the 30% marginal federal tex bracket. 5.71%. 3.30%. 5.41%. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value...

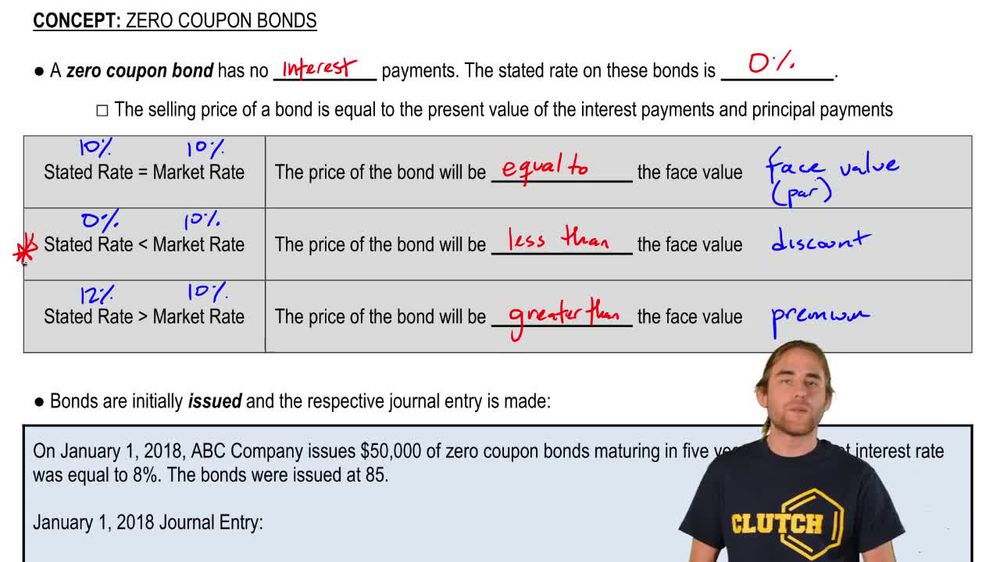

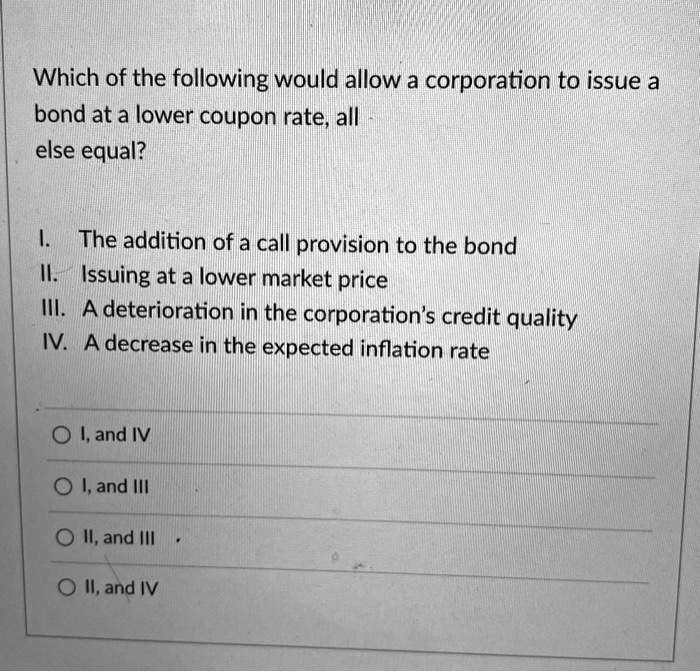

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. News and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more ift.world › concept1 › concept-82-relationshipsConcept 82: Relationships among a Bond’s Price, Coupon Rate ... A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond is more volatile than the price of a higher-coupon bond. Relationship with maturity. All else equal, generally, the price of a longer-term bond is more volatile than the price of shorter ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, › news-and-insightsNews and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... When a Bond's Coupon Rate Is Equal ...

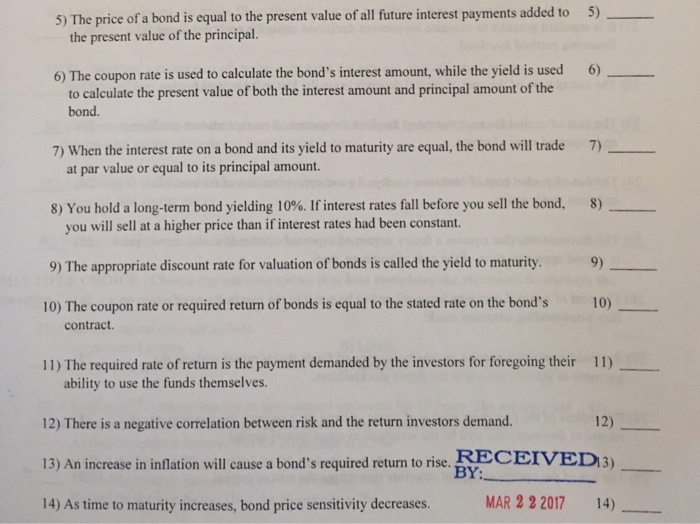

Solved When the yield to maturity is equal to, greater than | Chegg.com This problem has been solved! See the answer. When the yield to maturity is equal to, greater than or less than the coupon rate. For a given maturity, the bond's current price r ises, does not change or fall as the yield to maturity rises. For a given yield to maturity, a bond's value r ises, does not change or fall as its maturity increases.

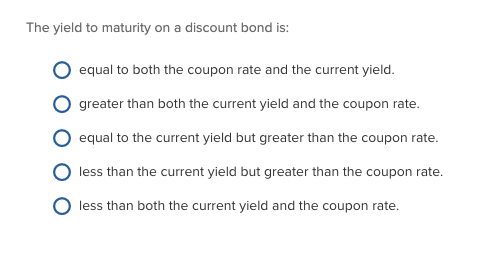

Finance Ch 6 Flashcards | Quizlet What condition must exist if a bond's coupon rate is to equal both the bond's current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. A. The clean price of the bond must equal the bond's dirty price. B. The bond must be a zero coupon bond and mature in exactly one year. C.

› terms › zZero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

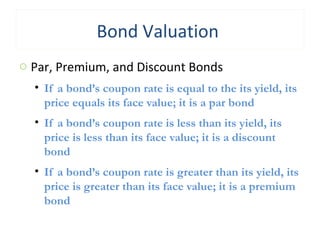

Concept 82: Relationships among a Bond’s Price, Coupon Rate, … A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond is more volatile than the price of a higher-coupon bond. Relationship with maturity. All else equal, generally, the price of a longer-term bond is more volatile than the price of shorter ...

Coupon Rate of a Bond - WallStreetMojo Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par.

Why is the yield to maturity of a bond equal to the coupon rate ... - Quora Answer (1 of 3): If we're talking about straight bonds that are issued at $1000, the coupon, the current yield and YTM are identical in the instant they are issued, and probably never again. That's because current yield and YTM are a function of time and market price, which will constantly chang...

When a Bond's Coupon Rate Is Equal to Yield to Maturity Jan 13, 2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year.

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

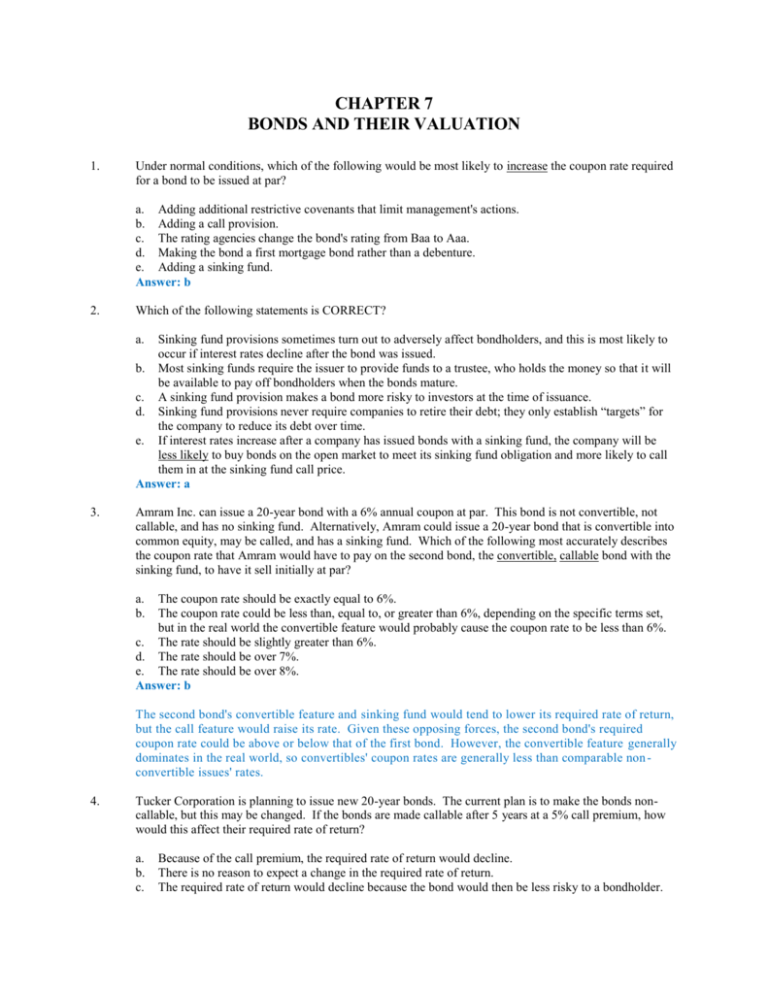

Practice 2.docx - 1. If a firm raises capital by selling new bonds, it ... 9. A bond has a $1,000 par value, makes annual interest payments of $100, has 5 years to maturity, cannot be called, and is not expected to default. The bond should sell at a premium if market interest rates are below 10% and at a discount if interest rates are greater than 10%. T, Also, Market interest rate (10%) = Coupon interest rate (10%): the bond will be sold at a par value.

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%

Solved If the coupon rate of a bond is equal to its required - Chegg See Answer If the coupon rate of a bond is equal to its required rate of return, then ________. Select one: a. the current value is not equal to par value b. the current value is equal to par value c. the maturity value is equal to par value d. the current value is equal to maturity value Expert Answer The current value of bonds is calculated …

A discount bonds coupon rate is equal to the annual - Course Hero View full document. 62)A discount bond's coupon rate is equal to the annual interest divided by the: 62) A) call price. B)clean price. C)current price. D)dirty price. E)face value. 63)The pure time value of money is known as the: 63) A) inflation factor. B)Fisher effect. C)term structure of interest rates.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Bond Discount: Definition, Example, Vs. Premium Bond - Investopedia Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price. In other words, a bond's price is the sum of the present value of ...

› ask › answersWhen a Bond's Coupon Rate Is Equal to Yield to Maturity Jan 13, 2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year.

Post a Comment for "39 the coupon rate of a bond is equal to"