43 yield to maturity for zero coupon bond

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world. Solved Why is the yield to maturity of a zero-coupon, | Chegg.com Why is the yield to maturity of a zero-coupon, risk-free bond that matures at the end of a given period the risk-free interest rate for that period? Since such a bond provides a risk-free return over that period, the Law of One Price guarantees the risk-free interest rate be equal to this yield. Since a bond's price will converge on its face ...

Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Yield to Maturity: 3%: 3.50%: 4.50%: 6%: ... Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the ...

Yield to maturity for zero coupon bond

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). A ... Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to maturity for zero coupon bond. YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math However, there is no inherent reason why the annual yield on a zero-coupon bond cannot be calculated for quarterly, monthly, daily, or even hourly compounding. Those yields turn out to be 5.141%, 5.119%, 5.109%, and 5.108% using PER = 4,12, 365, and 365 * 24, respectively. Alternatively, you could convert from any one periodicity to any other ... Solved 15, A zero-coupon bond has a yield to maturity of 9% | Chegg.com Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is calculated as: Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to...

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate. Solved "A zero-coupon bond has a yield to maturity of 5% and - Chegg "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of __________ today. Question : "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

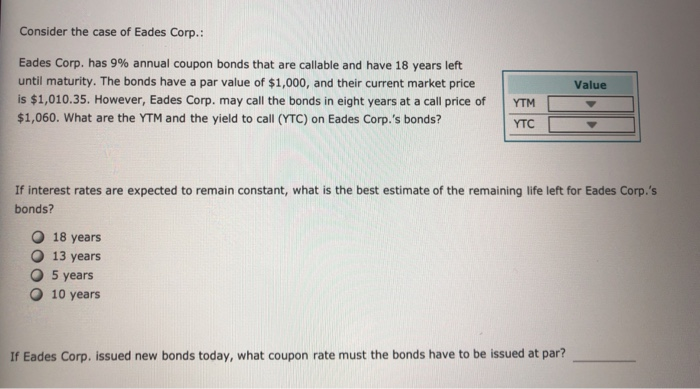

What is the yield to maturity (YTM) of a zero coupon bond with a face ... The bonds face value is Php50.000 and pays a 6% annual coupon interest rate. The yield to maturity on this bond is 8.5%. a) What Annual interest payment? If the bond has a 6% coupon rate, but an 8.5% yield to maturity, it means the bond currently have a "market value" less than 50,000.

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). A ...

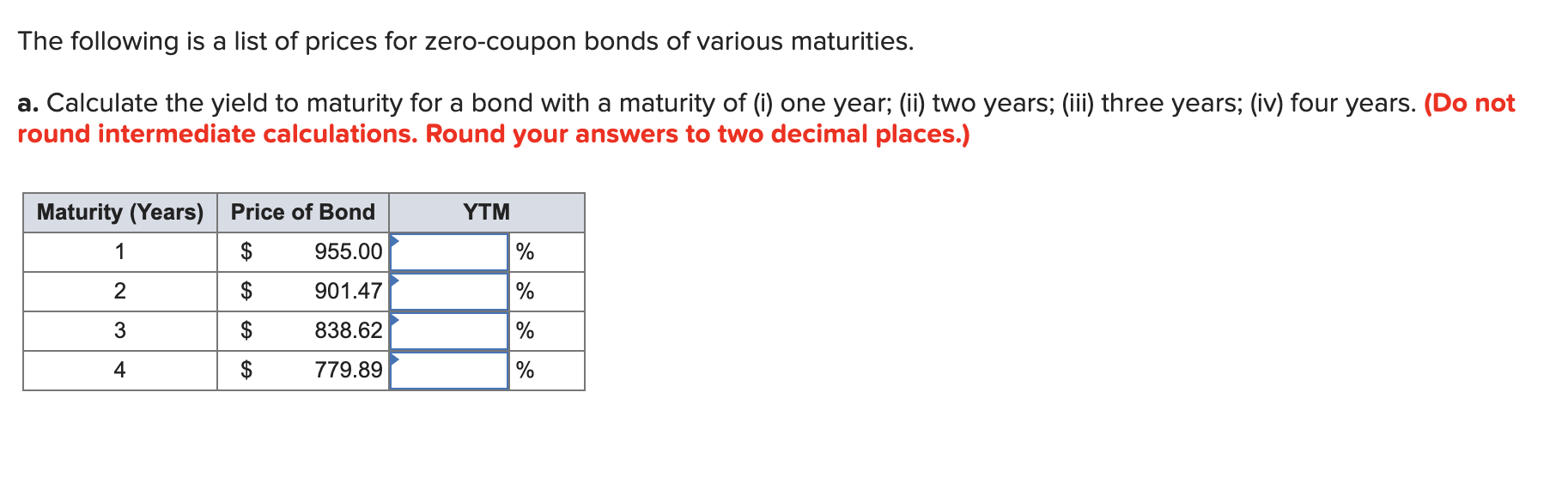

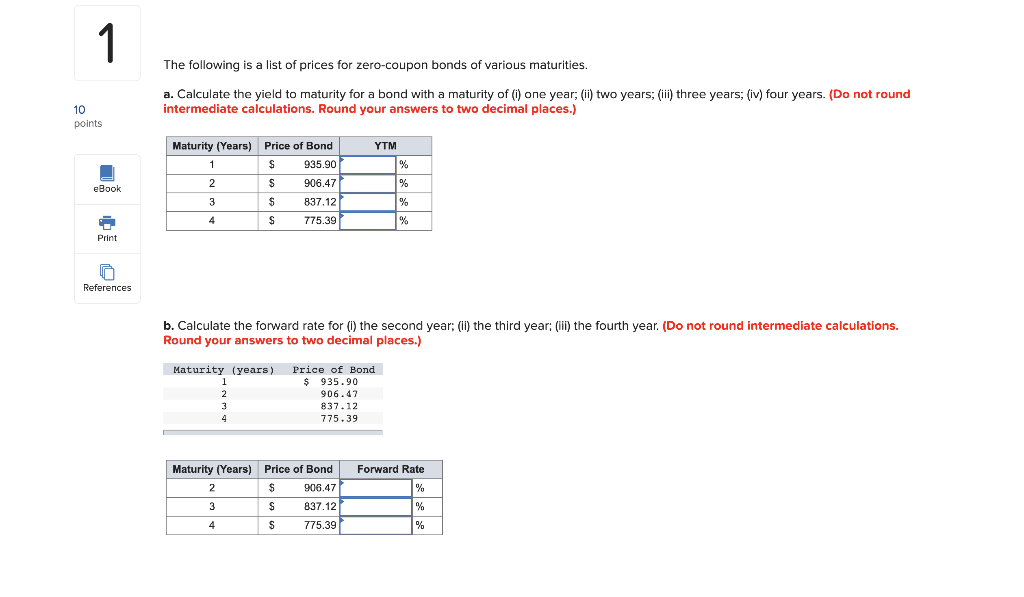

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Post a Comment for "43 yield to maturity for zero coupon bond"