44 zero coupon bonds advantages

Pros and Cons of Zero-Coupon Bonds | Kiplinger These bonds don't make regular interest payments. Instead, they're sold at a big discount to face value; when they mature, you collect the full amount. Their big advantage is that you know how ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Nov 25, 2020, 10:09 AM. Save Article Icon. A bookmark. Facebook Icon. The letter F ...

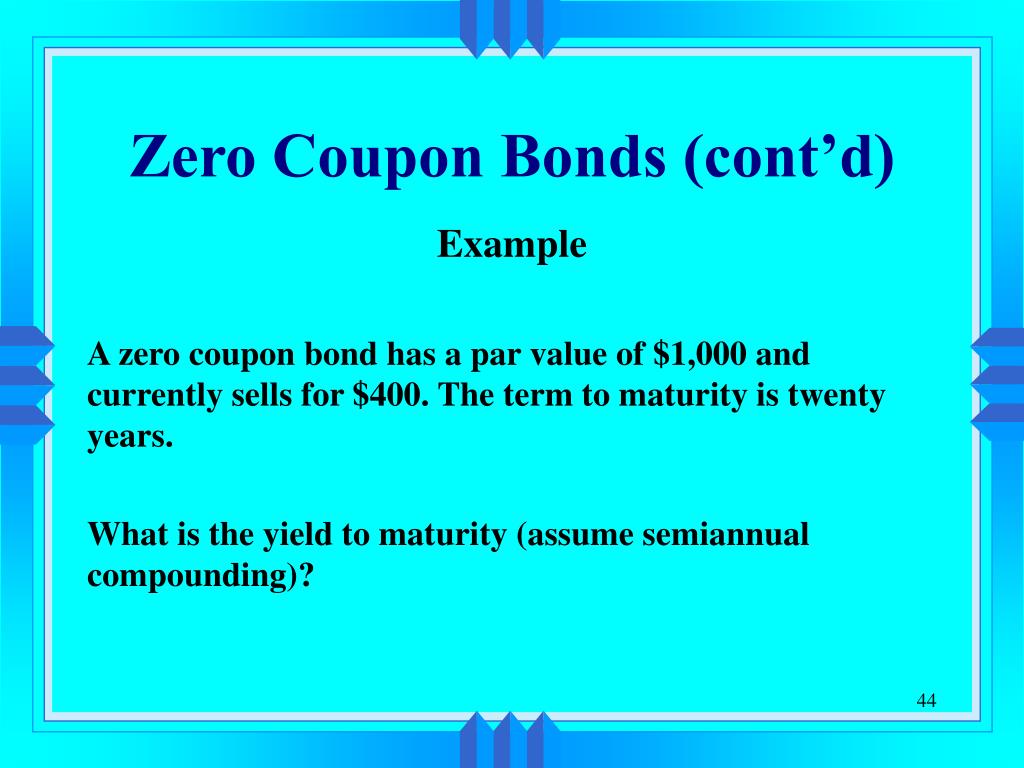

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

Zero coupon bonds advantages

What Is The Advantage Of Investing In A Zero Coupon Bond Advantage of zero coupon bond Guaranteed return Zero coupon bonds are issued for a rate much lower than the actual face value of the bond. Thus, it is evident that the investor will get the face value once maturity. The final price and the time when the investor will receive is defined, making it a guaranteed source of return on maturity. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

Zero coupon bonds advantages. The Pros and Cons of Zero-Coupon Bonds - Financial Web Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Advantage of Zero-Coupon Bonds From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Funds zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect forebear holdings at precisely the right time. The responsiveness of bond prices to interest rate changes increases with the schedule to maturity and decreases with interest payments. What is a zero-coupon bond? What are the advantages and risks? One advantage is that if rates are high, you essentially lock in that rate for the maturity of the bond. if rates go down, they gain value quickly. I can think of two disadvantages. One is that they lose more value if rates go up. The second is the tax treatment.

What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia What are the advantages of a Zero-Coupon Bond? Zero-Coupon Bonds prove to be a safer option as compared to other fixed income instruments. They render good returns at the time of maturity and if interest rates fall dramatically, there is an option to sell them in secondary markets. Source: Tavaga. Home. Pricing. FAQs. Under The Hood. Blog. How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Zero-Coupon Bond - Definition, How It Works, Formula Extending the idea above into zero-coupon bonds - an investor who purchases the bond today must be compensated with a higher future value. Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds Zero Coupon Bond - Finschool By 5paisa Advantages Of Zero Coupon Bond. They often have higher interest rates than other bonds- Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them more attractive to investors. As a result, these bonds often come with higher yields than traditional bonds. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

› en-us › investmentsPIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange ... Jun 30, 2022 · Aims to achieve the benefits of exposure to a long U.S. Treasury fund. The fund aims to achieve, before fees and expenses, the yield and duration exposure inherent in a long U.S. Treasury fund.

Zero coupon bonds what are the advantages and - Course Hero 1. Zero-Coupon Bonds. What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest ...

Zero Coupon Bond क्या है? - ICICIdirect 1. रिटर्न अनुमानित हैं. शून्य-कूपन बांड का सबसे महत्वपूर्ण लाभ यह है कि उन पर आपको जो रिटर्न प्राप्त होता है, वह पहले से ही ज्ञात होता ...

› articles › investingCorporate Bonds: Advantages and Disadvantages - Investopedia Jan 31, 2022 · Bonds that have a zero-coupon rate do not make any interest payments. Instead, governments, government agencies, and companies issue bonds with zero-coupon rates at a discount to their par value.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

› what-are-bonds-and-how-doWhat Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ...

What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Zero-Coupon Bond Definition - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead trades at a...

assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon ...

Advantages Of Investing In Zero Coupon Bonds The emergency situation fund is your safety internet to prevent this - Advantages Of Investing In Zero Coupon Bonds. While this is certainly an excellent target, you do not need this much set aside prior to you can invest- the point is that you simply don't wish to have to offer your investments every time you get a blowout or have some ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Post a Comment for "44 zero coupon bonds advantages"